10 charts that help to frame the state of startupland in 2024

Including commentary on each that nobody asked for

With the last few weeks of data from 2023 finally trickling in, we can now take stock of the year as a whole. If nothing else, 2023 represented a year of significant change in the realm of startups.

Basically every stage of private markets investing saw a pullback, as the inflation-driven public markets “SaaSacre” of 2022 made it’s long awaited way into the private markets. Decreased valuations drove a reduction in average deal sizes, but also deal count as the increased cost of capital proved that many startup ideas and businesses were proven to be not “venture fundable” in the long run.

In a world in which great data is scarce, Pitchbook & NVCA’s recent report on 2023 VC investing is a very helpful guiding light of what’s actually going on in the private markets.

The report itself is quite dense, but this week I’ve pulled out what I think are the 10 most interesting charts that help to explain where things are today, and what founders and investors should be thinking about going into 2024.

1. Public markets valuations returned to long-run averages

Tech valuations in the public markets cratered in 2022 as global inflation increased cost of capital and discount rates across the field. What’s notable, however, is that this was really a return to long run averages, from what was an explosion in valuation multiples in 2021. This means that valuations are unlikely to bounce back to 2021 levels anytime soon: the current valuation situation should be the new normal for the foreseeable future.

2. VC investment returned to pre-pandemic levels

Similarly, VC investment dropped off in 2023, but only really to pre-pandemic levels. While 2023 has been characterized as being a tough fundraising market, the asset class as a whole has grown significantly over the last ~6 years. As companies run out of cash and need to fundraise in 2024, I’d expect deal activity to bounce back to 2022 levels (albeit, at lower valuations than what we saw in 2021 or 2022).

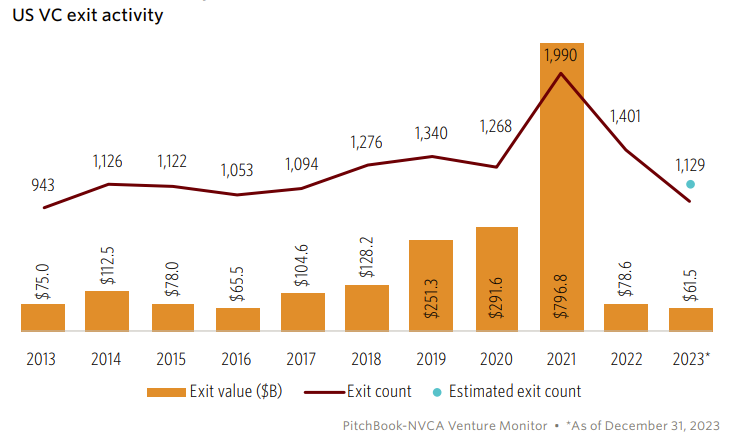

3. 2023 exit activity was astoundingly low

While VC investment in 2023 dropped off, VC exit activity absolutely cratered to a 10-year low. Both IPO’s and acquisitions were few and far between in 2023, as many late stage “zombie companies” deal with valuations that are now meaningfully disjointed from their public markets comparables. These companies will have to either post outstanding growth or accept much lower valuations if they want to go public or be acquired in 2024.

4. Valuation jumps between rounds have reduced sharply

Similarly, the expectation that a good company will always 2-3x its valuation between funding rounds has been challenged as well. Today, if a Company is able to complete a “successful” fundraising round, they’re only seeing a ~1.5x jump in valuation from their last round. I’d expect this number to actually come down in 2024, as we see more cash strapped companies forced into accepting down and flat rounds.

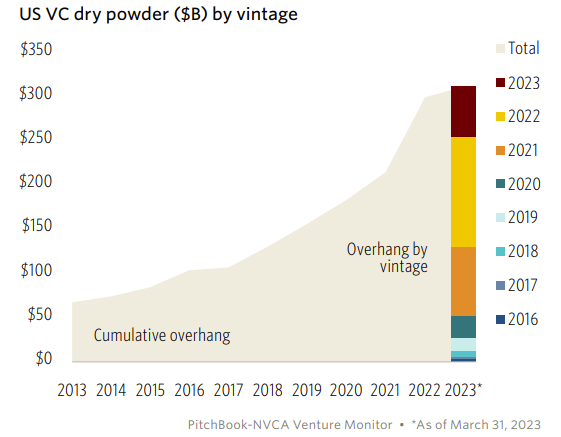

5. Dry powder increases yet again to all time high

While less capital poured into the VC sector in 2023 than in either 2022 or 2021, the significant pullback in capital deployment meant that the overhang of dry powder reached an all time high. Investors are now demanding more from startups, but they do indeed have plenty of capital to invest.

I expect that this means that the very best companies who are executing well will have no issue fundraising in 2024 (likely leading to oversubscribed rounds), even while many of their peers struggle to fundraise. In uncertain times we always see a “retreat to quality” in the public markets: I don’t expect the private markets to be any different this year.

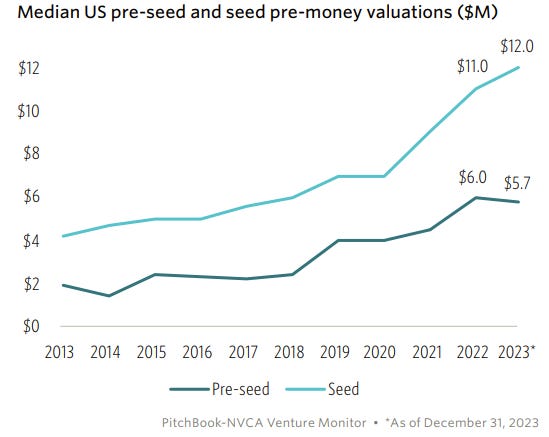

6. Despite headwinds, Seed deals more expensive than ever

Despite valuations decreasing everywhere else, Seed valuations have only continued to climb (and represent one of the few competitive stages in investing right now).

This can probably be described as a combination of i) overwhelming optimism about the future state of AI; ii) it being much easier to sell “the dream” of the future state of a company before any data comes in; and iii) the fact that many multi-stage funds are unable to invest in a “dead” later stage market, so are instead moving earlier into the Seed stage to attempt to do deals and appear busy (this is particularly true of young investors who can only be promoted by doing deals).

While Seed valuations have appeared to be immune to the market correction, I suspect that they will start to come back down to earth in 2024 as the rest of the market opens back up.

7. Corporate VC’s step in to replace PE and Crossover funds

As public markets valuations have returned to normal, several tourist investors have ended their brief foray into early stage venture. Crossover funds (whether classified as PE or Asset Managers in the above graphic) have taken a notable step back since 2021.

Corporations (whether directly themselves or via venture arms), however, have jumped right in to take their place. With massive cash balances piling up on their balance sheets, but an uncertain market environment in general, many corporations turned to making private market investments (as opposed to full acquisitions) in 2023. Nowhere has this been more prevalent than in the world of AI, where companies such as Microsoft, Google, Amazon, Nvidia, Oracle, and Salesforce have all made huge investments into the AI startup ecosystem, either by leading rounds themselves, or by meaningfully contributing to large fundraises.

Speaking of AI companies…

8. “Generative AI” companies erupted in 2023

In what will come as a surprise to nobody, 2023 was the year of AI in the private markets. While the tech market as a whole pulled back, “Generative AI” companies exploded. Generative AI as a term itself is very subjective, but Transformers-native AI companies were the true “haves” in the “haves and have-nots” of startups in 2023. The growth in the category was so significant that many believe AI to be a standalone bubble in a broader bear market.

While we’re big believers in the long term future of the technology, AI valuations are likely to come back down to earth in 2024 as some companies struggle to establish product-market fit and deep economic moats, and others aren’t able to post the exponential growth needed to justify higher and higher valuations.

9. AI infrastructure caught up to vertical applications

While the AI industry has been around a long time, “modern AI” is increasingly being built around LLMs / Foundation Models as the core infrastructure. This “replatforming” led to significant investments in the infrastructure layer of AI (labeled as Horizontal platforms above) in 2023.

This infrastructure layer has to be built first to enable a platform shift, but the aggregate market value for vertical applications almost always dwarfs the horizontal market in the long run. I’d expect a larger share of venture dollars to shift back to vertical applications of AI in 2024.

10. AI is eating the world (of VC dollars)

In what I think is the single most interesting chart of 2023, we can see that AI & ML VC investment sharply increased as a % of total VC investing (from 22.5% in 2022 to 36.7% in 2023). This shouldn’t come as much of a surprise given the prior nine charts above, but I think the stark inflection is as notable as I’ve ever seen in macro investing data. When historians look back at this data in the future, this will perhaps be labeled as the “ChatGPT effect”.

In 2024, I’m expecting AI’s market share to increase even further (particularly within Deal Count), even as valuations cool. It’s become clear that AI is not going away, and is arguably the biggest technological platform shift since the rise of the internet. Even if there are several large and notable implosions in the space in the coming months (looking at you, Stability AI), almost every company will begin to adopt AI meaningfully in 2024.

While I don’t expect this to happen this year, we will almost certainly have to drop “AI company” as a category in the coming years as AI becomes pervasive across the board (after all, how many “internet companies” do you hear about these days?).