Top down, bottoms-up, and all turned around

How the evolving market dynamics of Generative AI affect GTM decisions

All of a sudden, every Company in the world is scrambling to figure out their AI strategy. Some companies are looking for the best partners to leverage in the space, some are looking to build their own solutions in house, and others still are looking to acquire their way out of ignoring the space until a month ago.

A few years ago, corporate executives were hesitant to purchase anything from startups for fear of taking on too much risk. Today, the script has flipped and buyers are worried that they’re risking their careers by NOT partnering with cutting edge AI solutions. To capitalize on this, we’re currently experiencing a gold rush of AI companies being founded, as more and more buyers are clamoring for AI solutions to spend their annual budgets on.

While there are certainly elements of a bubble in the valuations of generative AI companies, the change in buying behavior is what seems to indicate that there’s a real signal amongst all the noise. Of note, unlike the last VC market bubble of “Web3” companies, many AI businesses are already seeing revenues take off. One only has to look at the rapid disappearance of “Web3 Investors” on LinkedIn to get a sense for how important this factor is to building a sustainable ecosystem.

While AI technology appears to be ready for the big leagues, AI businesses themselves are still nascent and don’t have a GTM playbook to turn to in the way SaaS businesses do: rarely are you just creating a “better version of xyz”, where you can copy their sales playbook. As the use cases for AI companies tend to differ from that of traditional SaaS (as value creation and value capture have been turned on their head), they require more experimentation to find PMF. We recommend the Founders return to the first principles of sales motions, in order to select the GTM motion that fits best with their business.

Revisiting first principles: top down versus bottoms-up

For tech companies and startups, there are typically two types of sales motions that B2B business use to get in front of their customers: a top down motion, or a bottoms-up motion. These are frequently rebranded to sound new and trendy (PLG! C-Suite Sales!), but they’ve been around forever and are quite self explanatory in their naming conventions. Businesses either try to sell large contracts into the most senior, often C-suite executives who make decisions for the entire org (top down), or sell small contracts into the users who will actually be using the product themselves, in an effort to drive viral internal adoption (bottoms-up).

Before everyone comes running to point me towards examples of large companies that leverage both types of sales motions, there is almost always one dominant / primary motion that has defined a business. For startups in particular, where focus and prioritization of resources is key, we typically recommend startups to prioritize one over the other.

A top down sales motion (aka C-suite sales, or traditional enterprise sales) requires building out an army of account executives (AEs), Sales Development Reps (SDRs), and Customer Success Reps (CSRs), who identify sales prospects and try to push them through a sales funnel via multiple calls (e.g., demo’s, pricing, IT integration, etc.). Once a customer is signed on, AEs and CSRs try to nurture that customer, make sure they’re happy, and ultimately get them to expand their contract when it comes up for renewal. It can take a long time to move a customer through a funnel, but typically average contract values (ACV’s) are very large, and annual customer churn is very low due to annually structured contracts.

On the flip side, bottoms-up sales (aka product-led-growth / PLG) involve building out an intuitive to use product alongside a large inbound marketing organization (or, increasingly, a Developer Relations team) that draws end users to your website where they can then quickly and easily trial your product themselves (without C-suite buy-in). Once a customer is using the product, the expectation is that they will recommend it to other users within their own organization, with the hope of this igniting viral adoption and usage. The ACV’s of bottoms-up sales tend to be much smaller and often experience a lot of early customer churn, but benefit from shorter sales cycles and lower customer acquisition costs (CAC).

The below image is certainly an oversimplification, but represents a brief overview of how I think about the pros and cons of each sales motion:

I would point out that while the first four factors tend to lean one way or another (but not always), I don’t think either model has definitely shown to enable faster growth or greater capital efficiency (despite what the recently vocal PLG mafia will try to convince you of). Some top down companies convert and expand on massive contracts that significantly outweigh their sales headcount, and some bottoms-up companies have grown so explosively virally that they quickly make up for having lower ACV’s: I don’t think there’s a one size fits all model that works best.

The double edged sword of usage-based pricing

If that weren’t enough, another important variable to consider is how to price your product as a startup: either as a guaranteed contract, or via usage-based pricing.

If a customer signs a guaranteed contract (often a seat-based contract), you can forecast exactly what your revenues will be. Having predictable and repeatable revenues is a very good thing, and is part of what makes SaaS companies such good businesses. However, if your cost of goods sold varies with how much a customer uses your product or service, you might end up in a scenario where some high usage customers become gross margin negative.

On the flip side, if a contract calls for usage based pricing, you might end up earning far less revenue from them than you had expected. In theory, usage based pricing ARR isn’t as “high quality” as guaranteed contracted ARR, as it’s not technically recurring (sometimes it’s referred to as re-occurring revenue, to highlight this distinction).

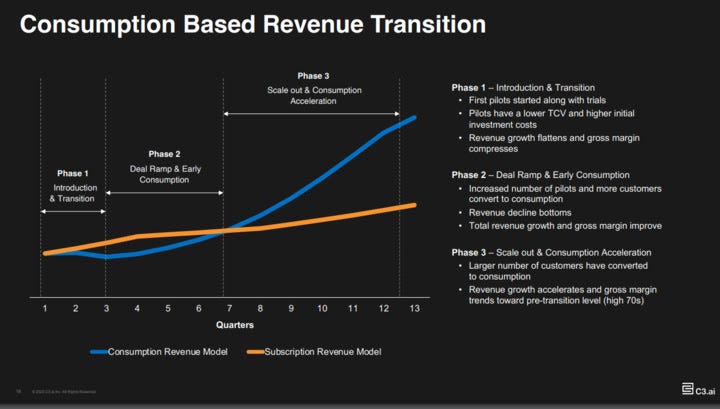

In practice, the decision between pricing models can be a tricky one: guaranteed contracts tend to be more recession proof and are viewed as higher quality revenue, while usage based contracts have the potential to grow much faster, and ensure gross margins stay high. C3.ai put out an interesting chart regarding their perspectives on the tradeoffs below (they refer to usage based pricing as consumption):

While the above chart would seem to imply that usage based pricing is superior in the long run, this ignores what happens in the downside case. The exceptionally insightful Jamin Ball examined this in one of his recent substack posts. Jamin notes in the below chart that usage based businesses are actually seeing a larger pullback in growth (LHS) than what one would expect to see if they were guaranteed contracts (RHS):

This is an interesting high level data point: even for the very best usage based businesses (Snowflake, Datadog, etc.), revenues contract meaningfully when customer software budgets are reduced. For startups and less established businesses, we’ve seen this effect to be even stronger.

In short, usage based pricing is inherently more cyclical than guaranteed pricing. For startups that want to leverage a usage based pricing model, we suggest trying to negotiate at least some level of minimum spend targets into your contracts, to help protect against inevitable cyclicality and lumpiness.

Know Your Customer

Clearly, we don’t believe in a one size fits all strategy. As we look at analogous companies in the Cloud software space, there are clearly world class businesses in every bucket (loosely grouped below into where I believe these businesses derive most of their revenues):

When advising AI startups trying to figure out their GTM motion, we typically recommend the following:

Start with your target customers. Who are they, and how often will they use the product?

Where does your product create the most value for customers? Is it for the Company as a whole, or for individual users themselves?

What does their organization look like? Is conformity across the organization important, or do individual users procure tools that fit them best?

What type of pricing models are they most familiar with? Which pricing model will incentivize them most to actually use a derive value from the product?

Lastly, how can you best communicate your product’s value creation to your customers?

For example, productivity tools in which users are interacting with one another on a daily basis (e.g., Zoom or Slack) tend to be better fits for a bottoms-up sales motion. For productivity tools that benefit from org-wide standardization (e.g., Office), top down motions tend to be better fits.

Business analysts tend to be more comfortable with guaranteed contracts (including seat based pricing), while software developers tend to be comfortable with usage based pricing on a per API call basis. Clearly understanding these factors before investing in a GTM function can save many startups time and money.

Takeaways for AI Startups

You can’t be everything to everyone (at least at first). Determine if you’re targeting C-suite executives or viral user growth

Tailor your branding and website to your end customer. It’s not helpful to dump Python code on non-technical buyers and vice versa

Be thoughtful about pricing: based on our experience, most AI companies we’ve seen are significantly underpricing their offerings. Don’t give value away for free!

Given the already expensive costs of serving AI models, it’s important to be laser focused on metrics such as gross margin, LTV, and CAC for AI businesses. Unit economics matter more than ever

Don’t be afraid to shift focus and pivot with the market: we’ve seen many businesses successfully pivot from one sales motion to another as market demand evolves. The market is moving fast, so you’ll need to move with it

Despite the press and market hype, the best investors are ultimately looking to back enduring, defensible businesses that have a clear path to profitability. Having a key grasp of this concept will be critical to building the best businesses that are around for the long haul (and don’t explode in a ball of flames). While building exciting technology and products is the first step, the next step involves building out a best-in-class GTM function.

While this article was more general in nature, in a subsequent article I’m planning on revisiting where different types of AI companies (from the infrastructure layer, to the application layer) are shaking out on these GTM decisions, in an attempt to identify early winners and best practices. For those of you making these decisions today, I’d love to chat about what you’re seeing.