What happens to startups when the public markets implode?

... and is the AI-hype train going to be affected by any of this?

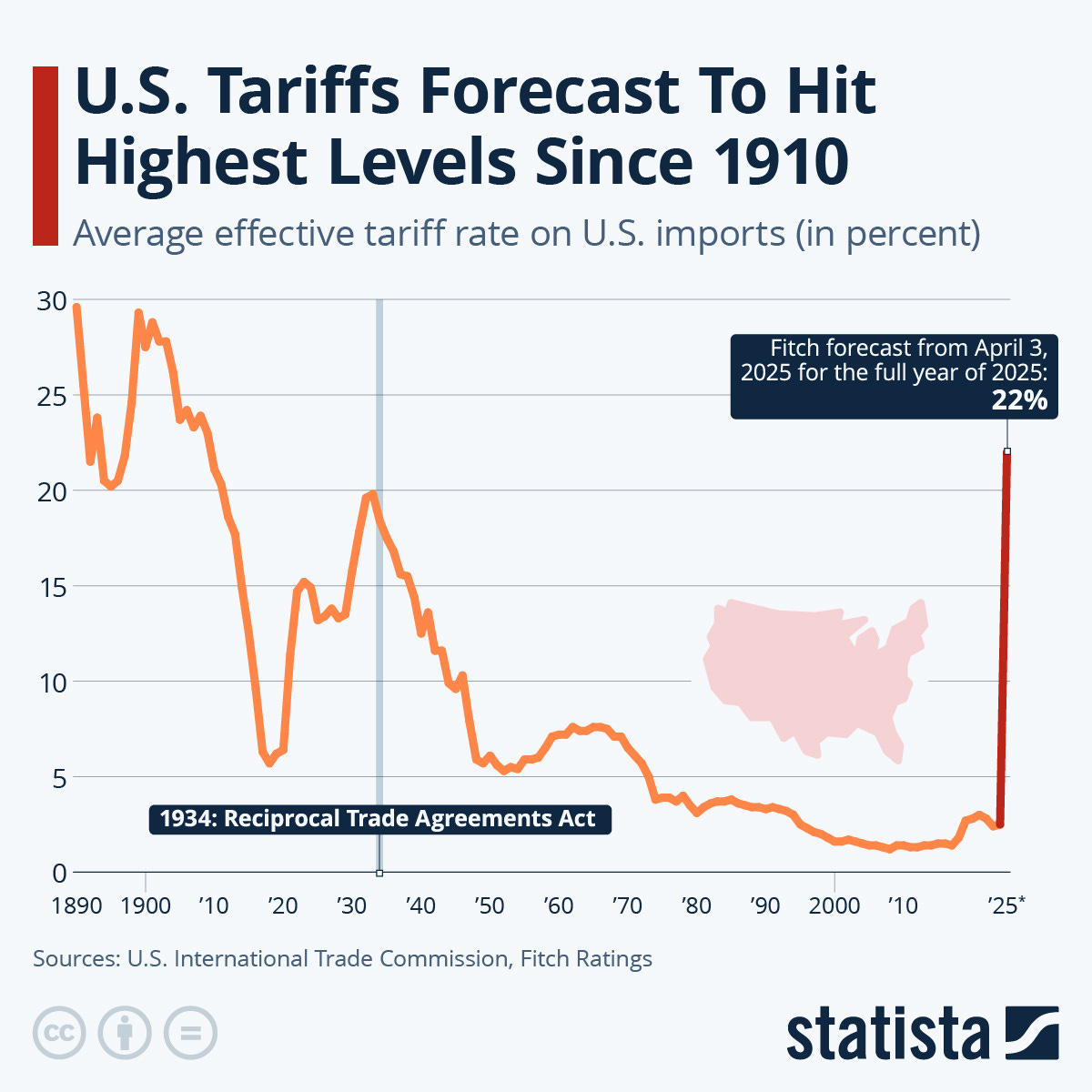

Over the last week, the global markets have plunged on the news that the U.S. is rolling out tariffs to levels not seen for over a hundred years. After five years of incredible returns, we’re rapidly approaching recession territory again.

Even more notable than the plunge in public equities is the sharp rise in the volatility in asset prices. The VIX (an index that tracks the volatility of public equities) has now reached the highest level since March 2020, and the second highest level since the Global Financial Crisis:

Needless to say, public markets investors are freaking out… but what does that mean for founders and employees at startups (particularly in the world of AI)?

The Macro Data

Tomasz Tunguz shared incredibly helpful analysis earlier this week that showed a 1% decrease in the Nasdaq generally equates to a ~0.5% decrease in Series A valuations (though, it takes two quarters to show up in the data).

This effect is more pronounced at growth stages, where most data suggests that a 1% decrease in the Nasdaq decreases valuations by ~0.75%.

This year, the Nasdaq is down about 20% YTD. This would imply a 10% decrease in valuations at Series A, and a 15% decrease in valuations at the growth stages. This happens for two reasons:

First, a decrease in public markets valuations means that private markets investors are underwriting investments to a lower exit multiple (the price at which a company will eventually go public or be acquired).

Second, an increase in global volatility means that investors are less sure of what the future will look like, so they are less confident making bets today. In other words, more investors are waiting on the sidelines than before (which decreases the total supply of capital).

The AI-lephant in the room

Up until recent news, AI companies in the private markets had been experiencing an incredible run of investor fervor. The hottest companies were being valued at 50-100x ARR, even while public comps were trading at ~10x.

To generate venture returns (25-30% IRRs), this means that investors were expecting some these companies to grow revenues 30, 40, or even 50x over the next five years.

Even if you consider that early data has shown that AI companies are growing faster than ever before, these are incredibly optimistic expectations to say the least.

As we’ve spoken about before, even the biggest AI bulls have called this phenomenon a “bubble in a bear market” (or, an unstoppable force poised to meet an immovable object).

Today, as the market has compressed and volatility has skyrocketed, all investors are beginning to consider whether this finally injects some level of rationality into startup land.

What happens next?

Now comes the hard part. What does this mean for the founders, employees, and investors in AI startups? Below are some of my predictions:

The best companies are still able to fundraise just fine. There’s often a flight to quality in times of economic turmoil, as market leaders see outsized benefits.

Valuations come down noticeably, but they don’t crater. Most people still agree that this is a golden era to build AI companies. I’d expect round valuations to drop 10-30%, but I don’t expect to see down rounds for the best AI companies anytime soon

There’s a return to fundamentals and business metrics. Even at growth, some companies have been able to fundraise based on hype, storytelling, and the underlying merits of their team. While this all remains important, successful fundraises will be dictated by actual business results going forward

I.e., companies go back to raising Series A’s, B’s, and C’s at more traditional A/B/C metrics. This means that while round valuations themselves may not decrease that much, ARR multiples DO contract meaningfully

Fundraising processes take MUCH longer. As investors are spooked, they’re going to require more time to get comfortable with companies. This means more meetings, more data, and more patience from founders

This means that founders will have to spend more time fundraising and getting to know their investor partners, instead of just running sprint auctions. This is a good thing for everyone!

The time between fundraising rounds increases. Given the above, I’m expecting fewer fast-follow and pre-emptive rounds, and more traditional processes. More companies will go one, two, or even three years between fundraising rounds

Enterprise buying cycles lengthen. Similar to investors, buyers at big enterprises are spooked too. I’d expect that this means slower sales cycles, and therefore a slight reduction in ARR growth for most startups

Startups reduce spend and extend runway. If customers aren’t buying, startups don’t need to hire armies of AE’s to sell or engineers to rush features into production

Long story short, everything is going to be fine, it’s all just going to take a bit longer.

If you’re a founder, this likely means that you should be spending more time delivering value to customers, getting to know future investors, and nailing your metrics and KPI’s.

If anything, a move away from hype and FOMO-driven processes is good for everyone. I still believe that there’s never been a better time to build a company, but this is a good reminder that hard things always take time (nobody ever said it was going to be easy!!).

We’re just as excited as ever to chat and get to know everyone changing the future with AI.

It’s (still) time to build!

Well written Ryan! Appreciate the guidance. All your points seem to apply to seed stage companies. What do you think?