Is 2023 the very best or the very worst time to be investing in AI?

7 Charts that help explain a bubble in a bear market

Over the last few weeks, there has continued to be a steady drum beat of massive AI fundraising rounds. Last week alone, Hugging Face raised another $235M at a $4.5B valuation, Modular raised $100M at a rumored $600M valuation, and Poolside raised a $126M Seed round and relocated to France (???). So much for August historically being a quiet month for VC news.

Massive AI fundraising rounds are nothing new in 2023, but three $100M+ rounds in one week jump off the page. What makes this particularly notable, however, is how this fits into the broader market backdrop: long story short, the VC markets - Growth Equity markets in particular - are dead right now. Why are they dead? Let’s dig into it:

Charts!!

Since the Global Financial Crisis in 2008, U.S. interest rates have remained near-zero, as inflation stayed low and the U.S. economy grew at a “reasonable” pace. In 2016, as the economy began to recover and return to normalcy, rates were raised again, but were quickly slashed at the beginning of the pandemic to stimulate a struggling economy. This led to a return to a low interest rate market, in which money was exceptionally “cheap” to borrow / spend.

Over the last two years, however, the global economy has begun to overheat once again. Decades of cheap borrowing, globalization falling out of favor, and a war in eastern Europe have all contributed to significant global inflation, as rampant demand coupled with broad supply shortages have driven increases in the prices of most goods. To combat inflation, most central banks (the Fed included), have raised interest rates meaningfully over the past two years (data from St Louis Fed):

Even with the climb in recent years, Interest Rates are still meaningfully below their long run averages. Despite what some VC’s will tell you, I don’t think it’s fair to call this a high rate environment: if anything, current interest rate levels are probably closer to the “new normal” for the next decade.

What do interest rates have to do with startups? We’re getting there, I promise. But first we have to look at the public markets.

As the Federal Funds rate moves up and down (loosely referred to as the “risk free rate”), so to does every other interest rate. If investors can earn a high return from low risk assets, they have to expect an even higher return from riskier assets. As the risk free rates increases, so does the “cost” of all capital.

The cost of capital is used to “discount” future earnings (as cash today is inherently more valuable than cash in the future). As this discount rate goes up, all businesses are inherently less valuable.

The key point here, though, is that this is especially true for high growth technology companies. As Tech companies are invested in based on the promise of future growth (instead of current profitability), they are far more sensitive to changes in interest rates than businesses in other sectors (for my fellow finance nerds: MORE of their enterprise value is tied up in the Terminal Value of their DCF).

We can see this play out in the data itself. As interest rates have increased, the valuation multiples of publicly traded tech companies have come down meaningfully since their run up from 2020-2022 (data from our friends at Meritech):

As public tech company valuation multiples have compressed significantly (from ~20x NTM revenue in 2021 to ~8x today), private company valuations have followed. While the private markets have lagged the public markets for a few quarters, we’ve now seen a similar impact on VC deal activity over the last year:

US VC Deal Activity by Quarter (data from Pitchbook’s Q2 VC report):

VC funding dollars deployed in the first half of 2023 were roughly half of what they were in the first halves of 2021 and 2022. This can largely be explained by the compression of valuation in the public markets: as public markets valuations compress, the “exit value” of what investors expect their private companies to be worth one day compresses as well. If you still want to target venture returns over your hold period, this means that you have to pay less upfront.

All of a sudden, now that capital is “more expensive”, a bunch of business models don’t work anymore. What could’ve been a good business in a low rate environment suddenly shouldn’t exist at all in a high rate environment (cue the “ZIRP” memes about 15-minute delivery businesses).

This means that investors are going to make fewer investments going forward as only the very best businesses are able to raise capital, and a larger portion of startups are deemed to be undeserving of the suddenly “extremely expensive” VC funding.

As one might expect, a tougher fundraising market doesn’t just mean fewer deals: it also means the deals that are getting done have terms that are less favorable to Founders. Q2 2023 represented the highest frequency of down & flat rounds in recent history, meaning more startups than ever are willing to take reductions in their valuation to stay alive and fight another day:

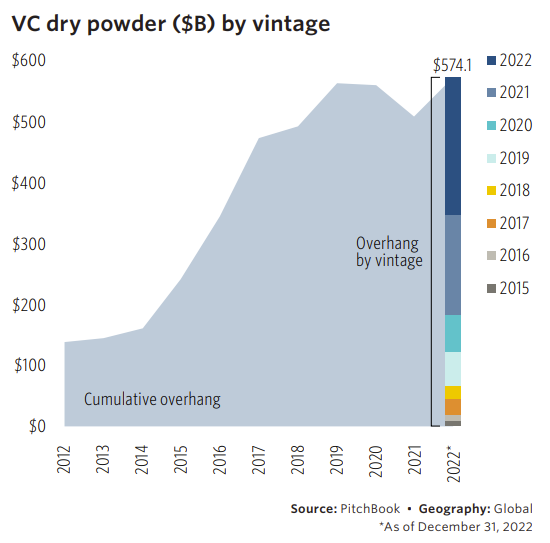

Returning to VC Deal activity, 2023’s VC deployment pace has clearly decreased versus 2021 and 2022, but it looks to be in-line with the long run historical average. However, this comparison ignores the massive amounts money that have been allocated to the sector over the last three years, most of which is now sitting on the sidelines (“dry powder”, or committed capital):

We’re now at an all-time high of ~$600B of dry powder sitting in the global markets, meaning that there’s more money than ever before waiting to be deployed in venture capital.

As this is meant to represent capital that VCs think they can deploy effectively over the next few years, they charge fees on all of it. If VCs think there’s no opportunity to spend it wisely, they’re supposed to return some of it to investors (or, as Founders Fund did recently, stop charging fees on it until you’re ready to deploy it).

Furthermore, these fees also net out against financial returns (Net IRR or Net MOIC), creating a drag on performance as funds sit around waiting to be deployed. These returns are how managers are evaluated, benchmarked, and compensated, meaning they’re incentivized to deploy capital instead of just letting it sit around collecting management fees.

Long story short, investors are always going to be incentivized to deploy capital. However, in the current environment, valuations have plummeted. Low exit valuations mean that the bar for funding a startup has been raised significantly.

What happens when there’s more money than ever before sitting around trying to invest in an increasingly small group of “only the very best businesses”? In short, a big problem.

AI to the rescue!

In the face of a crumbling tech funding market, a Messiah emerged to bring hope back to the people: an AI application by the name of ChatGPT. ChatGPT launched in November 2022 and quickly became the fastest growing product, ever:

This was Modern AI’s breakout moment, as the world woke up to its capabilities. Every tech investor in the world has seen a potential lifeboat: if ChatGPT can grow at unprecedented rates, maybe other AI startups can “make the math work” in a low interest rate environment too.

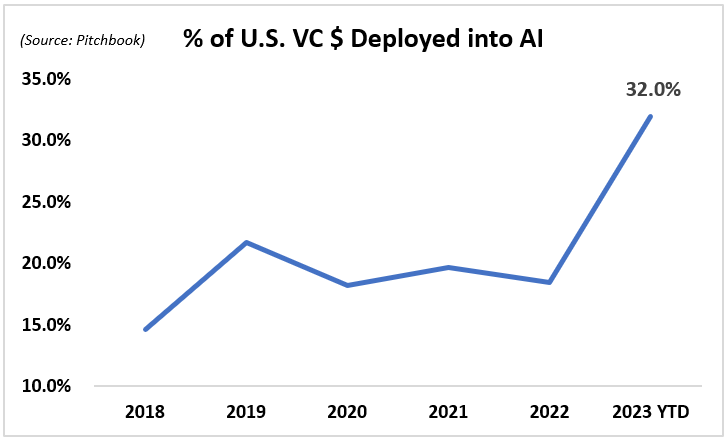

If the massive headlines regarding AI funding rounds weren’t enough to convince you of this, I pulled the “market share” of AI funding rounds amongst all US-based VC funding rounds below: clearly, AI is eating up more and more share of total VC dollars. Based on what we’re seeing, I think this is only going to continue to shift upwards as more funding rounds are announced:

Market bad. AI Good. What mean?

Putting it all together, there’s a ton of capital out there in the market that needs to be deployed, but the market itself is grim. AI, however, remains the lone bright spot in a sea of bleakness. Pretty much every investor can see that 2023 has been a banner year for development in the field, and almost everyone is in agreement that it’s the most exciting technological step-change since the shift to cloud computing (if not the internet itself).

What does this mean in practice? Basically, every generalist investor is turning to the category in the hopes of finding something to dump their dry powder into and get them out of this mess. At this point, if you’re a startup but you’re not already an AI company, you’re probably not getting funded in this market environment.

What do we get when we mix a breakthrough technological step change that creates real economic value with a market fervor that smells a lot like an asset bubble? Honestly, I’m not sure anyone knows the answer for sure.

In 2021 the Crypto / Web3 space experienced the same overwhelming investor interest, before imploding on itself… but I’m not sure there ever really was any economic value being created by any of those products or services (as you might expect, I have never owned any cryptocurrency… though I sure wish I bought Bitcoin back in 2015).

Modern AI very clearly creates economic value for society (even if just accounting for productivity gains). I don’t think you can look at the explosive growth in usage of ChatGPT and call that pure market hype.

Seeing Nvidia absolutely crush their earnings last week lends even more credibility to the promise of AI revolutionizing the economy, and has probably convinced even the most bearish of investors that AI is here to stay.

Predicting the future

As I mentioned, it’s hard to predict exactly what comes next here. The incredible pace of development in the field of AI combined with the market fervor of investors dumping capital into any startup the has a “.ai” domain name feels a little bit like an unstoppable force meeting an immovable object.

However, the job of an investor is to attempt to make predictions in the face of incomplete and inconclusive information. As such, I’ve put together a few of my thoughts on what I think will happen next:

There will be both massive winners and massive losers in the space, but it won’t be obvious which is which for another few years. Significant amounts of capital are going to be created and destroyed by these companies

Over the next few years, there will be many investors who pick the right horses and still end up losing money as valuations rationalize: particularly in some of the massive Seed rounds

The current market environment has led to some investors coming back around to touting the “capital as a moat” strategy originally pioneered by SoftBank. If only there were some recent datapoints regarding how that works out in the long run…

Given the capital intensity of AI businesses, a lot of Companies will need to raise growth-stage funding rounds without having traditional growth-stage metrics. I suspect a new “class” of growth equity investors to emerge in this moment (with the ability to take early stage risk type of risk at the growth stage)

On a related point, strategic investors have become more important than ever: with massive amounts of cash on their balance sheets, strategics are being leaned on to fill out the massive rounds being priced by financial investors. I think this codependent relationship sticks around for the foreseeable future

Given all of the above, we continue to feel very confident in our strategy of building an AI specialist firm that backs world-class technical teams with differentiated technology. While it’s getting harder and harder to pick the “very best businesses”, the very best AI companies tend to succeed in ways we’ve never seen before: we continue think this warrants developing firm-wide expertise.

If nothing else, I don’t think there’s a more exciting category in the world to be spending time in… Makes it tough to take vacations, though.

Agree? Disagree? Think I missed something? I’d love to get your feedback and thoughts below!