Disruption in the AI era: revisiting the dot com bubble

Did Pets.com have all the answers this whole time?

A few weeks ago I shared some thoughts on what I thought moats would look like in the era of AI. Since then, I’ve gotten a lot of great feedback from entrepreneurs and executives on how they’re thinking about moats, and how foresee their evolution over time.

These discussions have inspired me to investigate a similar but distinctly related topic: disruption. Coined by Clayton Christenson in 1995, Disruptive Innovations (“disruption(s)”) are innovations that create new markets, or innovations which eventually displace market leading firms / old markets. It’s important to note that not all innovations are disruptive, but the ones that are tend to follow similar patterns.

I think it’s safe to say that recent AI breakthroughs are going to cause huge amounts of disruption in some spaces, but minimal amounts of disruption in others. The million (billion?) dollar question for investors here is attempting to identify where AI will facilitate large amounts of disruption, and when to back the Companies driving that change prior to it becoming obvious to the broader market (in investing terms, this is sometimes referred as identifying characteristics of a business that have yet to be “priced in” to the businesses underlying equity value).

Prior to looking at what’s going on in the world of AI today, I think it’s helpful to reflect on the past to see what lessons were learned and what insights we can draw.

What does it actually mean to be disruptive?

First things first, it’s important to properly define disruption. While we gave the dictionary definition above I think it’s even simpler to define what ISN’T disruptive. An innovation that improves an existing market but does not materially change it is NOT disruptive (e.g., the shift from 4G to 5G internet has barely impacted telecommunications providers or their end consumers). Similarly, innovations that significantly change market dynamics for small groups of people but are never widely disseminated are also not considered to be disruptive (e.g., when private jets were commercialized in 1963 it only greatly impacted a very small group of wealthy individuals).

Where does that get us? Simply put, disruptive innovations change the way large groups of people do business or interact in markets (in business jargon this might be described as redefining value creation and value capture). In today’s world, there are many different groups of people / companies that claim to be disruptive, but few actually succeed in revolutionizing markets and the way we do business.

Before returning to the present, I think it’s helpful to draw parallels with the past. One of the most reiterated principles in the world of investing is that “past performance is not indicative of future results”. In short, this means that the past will not necessarily repeat itself in the future.

However, studying history is certainly not useless. In the past, I had the privilege of working for one of the most successful investors of the last 30 years, Jim Coulter. Jim was (an I believe still is), a large proponent of pattern recognition in investing: if you’ve seen something similar in the past, it should give you a good framework for how things will occur again in the future. He would occasionally quote Mark Twain on the matter: “History never repeats itself, but it often does rhyme” (will I ever write an article without leveraging a widely overused quote or idiom as a talking point? TBD).

He had another insight that I’ve always found relevant here: “the internet didn’t change everything, but it certainly made everything faster”. I think we’re experiencing another moment of accelerating disruption today, and as such think revisiting disruption in the internet era is doubly valuable as we try to unpack what’s happening in the world of AI.

Disruption in the internet era

The emergence of the internet was undoubtably a period of massive business disruption: it changed the way we earned money, spent money, communicated with one another, and lived our lives. Humans are inherently social creatures, and the emergence of the internet gave us access to all of the various “tribes” of the world at the click of a button (or, in the early days, over the racket of a dial-up internet connection).

It’s worth noting, however, that while the internet enabled the emergence of many disruptive business models that captured large amounts of value, the internet itself did not capture any: after being invented by the US DOD in the 1960’s and 70’s that was adopted by the broader public in the 1990’s. The internet itself is not monetized, and instead was a catalyst upon which other disruptive businesses emerged. There’s a clear analogy here with some of the recent breakthroughs in AI (neural nets, transformers architecture, diffusion models, etc.).

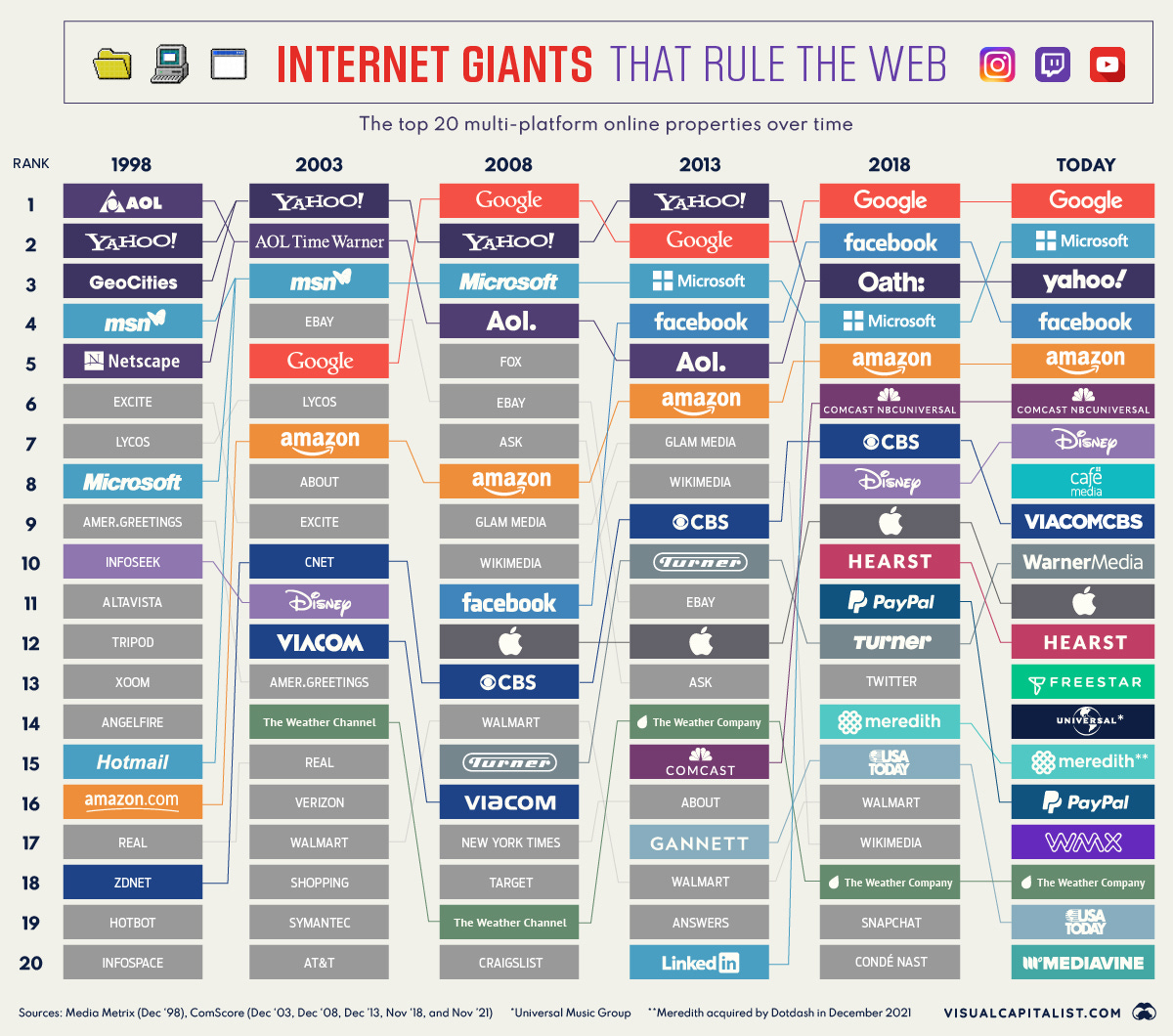

Secondly, many of the original internet businesses built in the 1990’s didn’t last forever. As shown in the below graphic from Visual Capitalist, about half of the top 20 internet platforms from 1998 don’t even exist anymore:

It’s clear that several of the first movers in the internet era were clearly just quick party tricks that weren’t ultimately great ideas in the long run: sometimes the first ideas that take off / go viral don’t really have underlying business fundamentals that make sense. Many of these businesses / business models captured the public’s attention initially, but were never able to build a true moat to survive in the long run.

On the other hand, it’s impressive to see how many giant businesses were built in the internet era that are still some of the world’s biggest today (Google, Amazon, etc.). Several of these businesses have been able to protect their core value proposition as new technological breakthroughs / platform shifts have occurred (e.g., Google and Amazon clearly were able to protect their market position through the shift to mobile). It took a few decades to play out, but the critical moat that emerged in the internet era became network effects, which was non-obvious at first. Many of the biggest internet Companies today weren’t founded until the mid 2000’s (e.g., Facebook), when network effects began to became better understood.

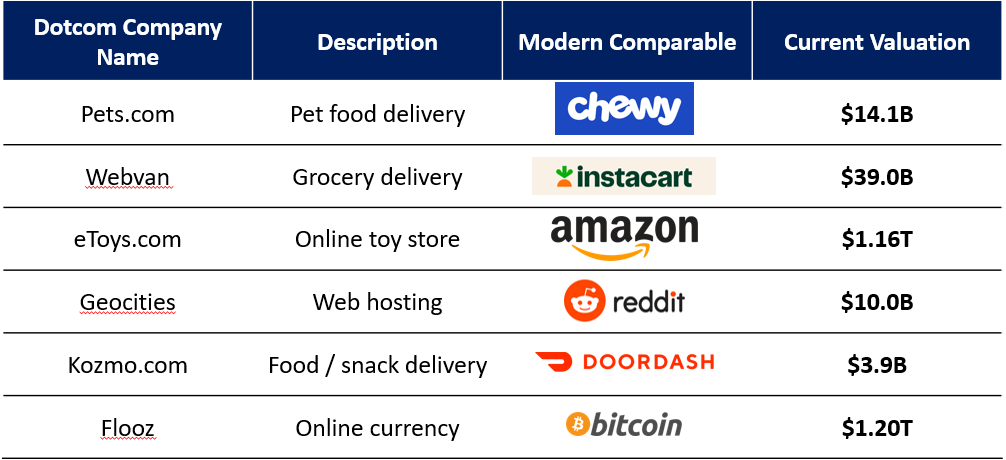

However, sometimes there’s another problem entirely: you have a great idea but the world around you and the relevant enabling technologies just aren’t ready for it. Consider the below chart which outlines some of the very largest dot com busts from the early 2000’s, alongside some more modern interpretations of the same idea:

While some of these are only partial analogy fits, I’m still impressed by how many of the early internet ideas have turned out to be commercially viable as the rest of the world has caught up (in particular, multiple delivery & eCommerce businesses have now become unicorns as the logistics industry has matured significantly). There’s another critical lesson here: timing matters. It’s not enough just to have first mover advantage or provide a new product or service to a small group of people: new technology companies have to be the first to get an idea RIGHT, and a lot of that has to do with the maturity of complementary / enabling products and services.

Disruption in the AI era

So far all we’ve done is dig through a dictionary and a history book. What does any of that have to do with interpreting disruption in the world of AI today? I would argue, a lot. After revisiting the above, a few ideas are top of mind for me about the lessons we can apply to today’s market:

Disruption is only possible if you can create new markets / ways of doing business, or if you can completely revolutionize existing markets.

I think this means that AI-enabled tools that are better than incumbent solutions but don’t fundamentally alter the way we do business are going to struggle to compete over the long run. I struggle to understand how AI-first productivity tools are going to provide better offerings than incumbents that are quick to adopt AI (e.g., Notion, Adobe / Figma, Hubspot, Salesforce, etc.)

One possible way to identify where this might happen might be to first identify clear innovators dilemma’s where incumbents will be resistant to changing the way we do business (e.g., Google’s dependency Ad revenue forced them to give the first mover advantage in chat to OpenAI / Microsoft)

If the internet made everything faster, I think the proliferation of AI is going to make everything faster, again.

What previously took a decade may only take a few years now: businesses are being disrupted faster than ever, but we’re also seeing startups rise and fall faster than ever before. It’s critical to look past early signs of traction and form a point of view on the long term durability of startups before investing

This is a double edged sword: while some incumbents may get disrupted exceptionally quickly, we will likely also see AI-first startups burn out and come crashing back to earth after early viral adoption

It took a long time for investors to determine that the critical moats in the internet era were network effects: we’re likely still in the early innings of identifying what those are for AI businesses.

I have hypothesized in the past that one of the most important moats in AI will be data moats, while others have hypothesized that viral usage and user communities are what will provide defensibility in this new era. The jury is clearly still out on this one, but I imagine the real answer will end up being a more nuanced take

The early risers in a new technological era may not end up becoming the biggest winners in the long run: sometimes the best ideas need more time in the oven.

While some early use cases of AI have quickly gone viral, I suspect the most compelling use cases and business models have yet to emerge as of yet. Like the internet, the emergence of AI is going to facilitate new business models and new ways of doing business: it certainly hasn’t all been figured out yet

On a similar note, timing is everything when it comes to investing in disruptive technologies. It’s easy to identify what the future will be at some point in time: it’s incredibly hard to forecast when the inflection in growth / adoption will occur.

I believe this is what is going to separate the good investors from the great ones in this new era: there’s a huge difference between what works in academia today and what will be ready for a production environment. Similar to the internet era, I suspect there will be several “AI era busts” that try to service problems that won’t be solvable until some point in the future

There will inevitably be a few critical enabling technologies that facilitate the growth and adoption of AI businesses, many of which are not ready yet and will hold up customer adoption.

One of the largest enabling technologies in my mind here is robotics: right now, modern AI is constrained to the digital world, but it won’t take long for solutions to be ready to tackle the physical world. When that happens, will the robotics supply chain be able to keep up, or will that become the critical bottleneck for widespread AI adoption in some verticals?

Those are the ideas that are top of mind for me right now, but I’d love to hear how others are thinking about this topic as well. If nothing else, sharing the above lessons / principles in public means I’ll certainly be wrong about a few (but hopefully not most)!