The Essential Building Blocks of AI Businesses

Where we think AI Companies differ from the last generation of Tech startups

2023 is clearly the year of the AI startup.

According to Pitchbook $10.7B worth of “Generative AI” deals were announced in Q1 alone (meaning they’re likely to close in Q2), a 5-10x increase year-over-year (I’m not sure “Generative AI” was even a buzzword a year ago: how times have changed). While this is impressive on it’s own, it’s staggering in the face of the broader macro environment: one in which US VC firms are expected to raise 73% less capital than they did in 2022, in-line with the lowest total capital raised since 2017. Said differently, Generative AI is white hot, while pretty much every other category in Tech has been left gasping for air.

The reason Radical Ventures exists is that we’ve always felt that AI businesses are different than traditional tech companies. They’re certainly being funded differently in this environment. But what really makes them different? What are the critical components of building a great AI business? This week I’d like to spend some time discussing how we think about building and supporting AI businesses, and ultimately what we’re looking for in companies.

In the age of the machines, it all begins with people

As Radical Partner Dominic Barton wrote in his 2018 novel, Talent Wins. This concept is doubly true in the age of AI, in which demand for AI skills has radically outstripped supply.

Over the past few decades, the world has trained millions of competent software engineers, to the point in which world-class training materials and exercises exist out there on the internet, for free. Today, there’s almost no “technical moat” to building software: with enough time and developers, almost any feature or architecture can be recreated.

This concept is untrue in the world of AI, in which deep understanding of the world’s most powerful technologies is limited to an extremely small (and incredibly young) group of individuals. “Modern AI” techniques didn’t start to proliferate until after 2012, and even today are primarily researched by brilliant technologists in highly prestigious and incredibly small Master’s programs at elite universities.

Furthermore, dealing with modern AI systems (e.g., LLM’s, Computer Vision platforms, etc.) is incredibly complicated, and borderline impossible to teach oneself: for now, building with AI is still extremely hard. The combination of these factors mean that there is an extremely small group of people in the world who can build new AI systems, and the competition to employ these individuals is incredibly fierce.

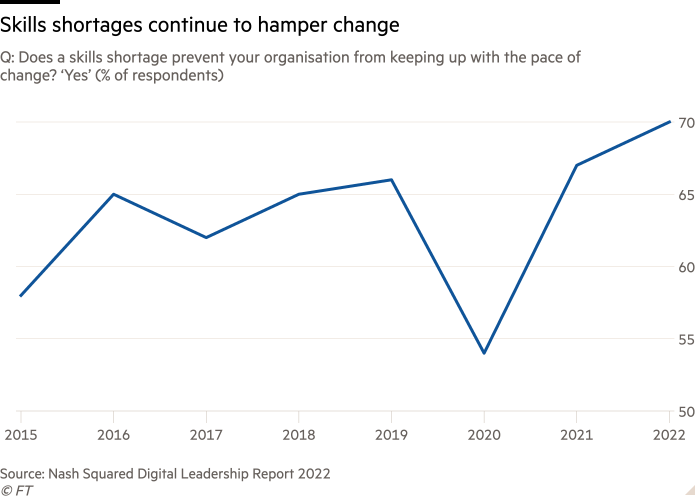

As the below graphic from the Financial Times shows, the emergence of AI has led to a record high skills gap in organizations, in which the vast majority of companies feel unable to keep up with the pace of change:

Simply put, the very best technologists in this world are both incredibly hard to find, and even harder to employ. Developing a proper technological talent acquisition and retention strategy is pillar #1 of building AI businesses.

The critical bottleneck: compute

We’ve spoken in the past about how critical cloud compute resources are to AI companies. AI models require massive amounts of processing power to be trained on their datasets, and that can sometimes be overwhelmingly expensive. However, it’s not as simple as throwing money at the problem to fix it. Over the past few months, an entire art of model training has emerged as various “tricks” and tools of the trade have been discovered to make model training faster and more effective (e.g., tailoring training runs to particular hardware setups).

In addition to the training and know-how, another factor has emerged in the realm of compute: even at the eye watering prices, there aren’t enough GPU’s to go around. The massive increase in demand for AI models has chip manufacturers like Nvidia scrambling to meet customer demand. In the last few months, all three of AWS, Microsoft, and Google have had to throttle customer's access to GPU resources as even the largest cloud companies have been unable to get their hands on their required resources.

This means that AI startups effectively have to pitch themselves to the global cloud providers in order to have the opportunity to use compute. I’m not sure I’m aware of any other industry in which you have to beg suppliers to have the privilege of spending millions of dollars per year as a customer, but we’re certainly seeing that happen in the field today.

This marks pillar #2 of building AI businesses: developing a strategy to procure and leverage cloud compute efficiently. Getting access to compute resources and squeezing more juice out of them than your competitors has emerged as a key point of differentiation among AI businesses.

The food that feeds the beast: data

AI models are worthless without good data: they are the epitome of “garbage-in, garbage-out” systems. Modern AI systems require astounding amounts of data to operate. For the most famous AI models of the moment, language models, many have been trained on the entire English language internet in order to become usable.

However, there’s a clear problem with using the internet as a data source: everyone else can use it too. We’ve talked ad nauseum in the past about data moats, and how we believe them to be the key differentiating factor for AI businesses. For your models to be more accurate than your competitors, the best strategy is to acquire or generate relevant data that nobody else has.

This is obviously easier said than done. Consumers and enterprises are more protective of their data than ever before. Determining a “data strategy” has become a critical aspect of building AI companies, as more and more companies are competing on the basis of having access to the best, proprietary data. Outside of brute forcing the collection of data yourself, developing a data moat typically entails forging partnerships with other companies and providers who have access to the data that you need.

More than ever, startups are looking to partner with data providers who can fuel their insatiable models. These are often mature businesses outside the realm of Big Tech, who have spent decades collecting datasets that have become incredibly valuable.

This marks pillar #3 of building AI companies: the development of a data strategy. In a world in which disruption and innovation is occurring at a blistering pace, the development and curation of proprietary datasets has emerged as the critical battleground of building enduring AI businesses.

The shameless plug: how we’re designed to help

Whenever I’ve been asked about what makes Radical different from other venture firms, I’ve always pointed to our Velocity team: a group of functional experts who work directly with our portfolio companies to provide specialized value creation for AI companies.

Radical was architected from the very beginning to be a venture fund designed to help AI companies address their unique business building needs. It should come as no surprise that we’ve been thinking about the above building blocks for quite some time, and that our Velocity team was constructed with the express purpose of addressing them. In addition to a swath of other services, we’ve looked to aid in the development of the the key building blocks of AI companies via the following:

Full time, world class AI talent experts. There are almost no recruiters in the world who understand what it takes to build technical teams in AI. We’re lucky enough to have two of the very best in the world (shout-out to Radical’s Talent team in Meg and Yvonne!). Radical’s Talent team helps to define the the talent strategies of our portfolio companies, identify technical needs, and drive the recruitment of critical technologists

A unique and proprietary compute procurement team. In what I believe is a truly one of a kind setup, Radical has a team dedicated to building relationships with global cloud providers and chip manufacturers, who act as a bridge between compute providers and our portfolio companies. This enables our companies to i) actually get access to the compute resources they need; and ii) benefit from our team’s experience and know-how to squeeze the most of our their compute spend

A programmatic data acquisition program. For AI startups, relationships and partnerships with large corporate enterprises are critical to building unique datasets for Machine Learning. Our Go-To-Market team has established relationships with a long list of Fortune 500 CEO’s who are looking to partner with AI startups and find ways to monetize their valuable datasets. By acting as the key intermediary between the two, we believe we can match the right enterprises and startups together to build differentiated data partnerships

Since Radical’s inception, we’ve always believed that AI businesses have their own requirements and constraints, and as such, require a different type of partner. As AI businesses continue to proliferate and scale, we believe the biggest winners will be the Companies that learn to navigate these challenges and assemble the best building blocks in each of their respective categories.

As always, if you think you’re building these building blocks today, we’d love to find a way to help.